Inclusive Lending

Equity and Efficiency, working together

Millions of creditworthy homeowners are overlooked - not because they can't qualify, but because traditional underwriting wasn't built to see them.

Greenlyne changes that

Built for lenders. Designed for inclusion

- Reach more borrowers – including homeowners in LMI and minority communities and operationally strong SMEs without traditional financial footprints – through advanced, automated, pre-screening and adaptive second-look models.

- Deliver offers that fit real people, not rigid defaults – so more borrowers can say, “Yes.”

- Streamline your team's workflow, freeing loan officers to focus on what matters: building trust and closing loans.

The Next Generation of lending Infrastructure

GreenLyne is the modern platform for credit - transforming how lenders underwrite and manage risk. We expand access to capital safely, responsibly, and profitably - supporting sustainable returns across underserved product and market segments while maintaining high quality performance.

Underwrite smarter. Lend fairer. Move faster.

Inside the Precision Finance Suite

Process every applicant or homeowner through our engine to quickly pinpoint fair and inclusive offers with equitable terms.

Automated Pre-Look empowers you to go directly to all HEROs with a conforming pre-approved firm offer of credit, before they come to you.

Automated Second Look allows you to examine every denial and optimize every detail around DTI, loan size, and price to find a conforming configuration.

Our internal engine learns constantly and adapts in real-time to each borrower’s financial situation.

Automated data blending, model learning and deployment

Learns from thousands of marketing and loan responses daily

Auto-tunes Predictive models to maximize inclusivity of reach across underserved cohorts

Automated self-evaluation and correction of Prediction Uncertainty

Auto optimizes loan size and debt-consolidation to make borrower’s credit risk viable

Pinpoint placement of right loan offer to the right borrower or the right "rescue" for the right denial

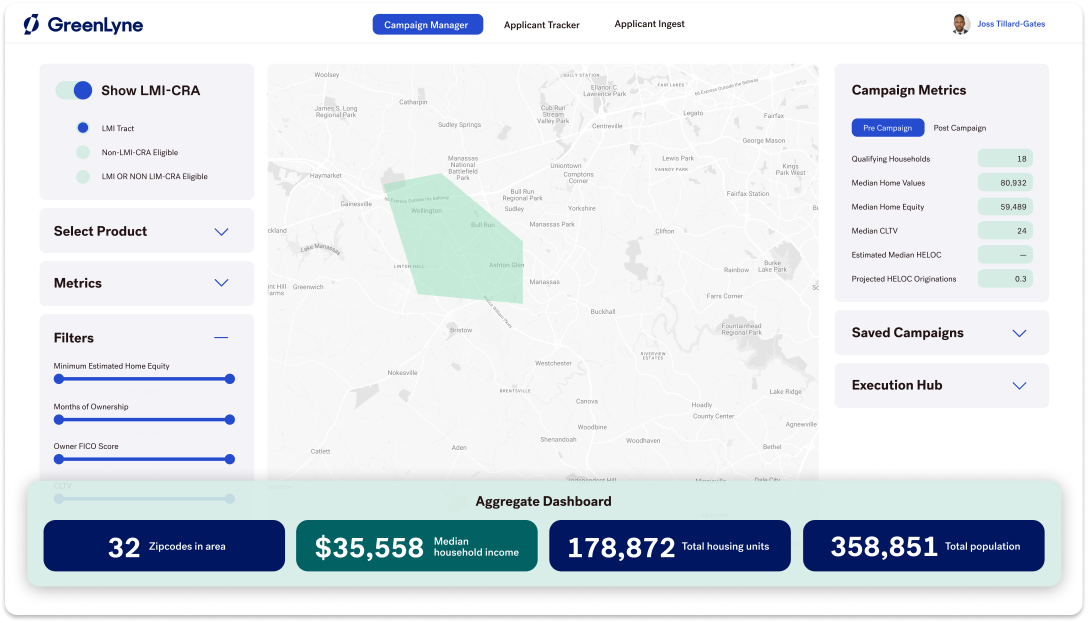

Pinpoint untapped lending opportunities.

- Pinpoint every HERO based on your search criteria.

- Review where responsible and profitable home equity loans can be originated in seconds.

- Execute personalized one-to-one marketing from the same platform.

The GreenLyne Difference

“Traditional methods don’t keep up with the combinations of credit scores, debt to income ratios, and cashflows of today’s homeowners. With GreenLyne, I can optimize loan offers in seconds.”

Loan Officer

The GreenLyne Difference

“GreenLyne partnered with us to optimize our process and reach new home owners. We’ve tapped into an entirely new market.”

Loan Officer